on

Startup Survey

I reached out to a few acquaintances who have recently been involved in or are planning to found a startup. My objective was to gather some quick and dirty data for questions that will inevitably emerge during the early days of a venture. I received feedback about the rigidity of the survey and lack of context for some questions. Still, I found the results directionally useful.

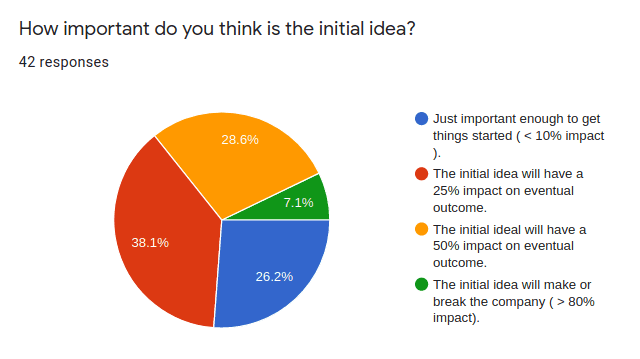

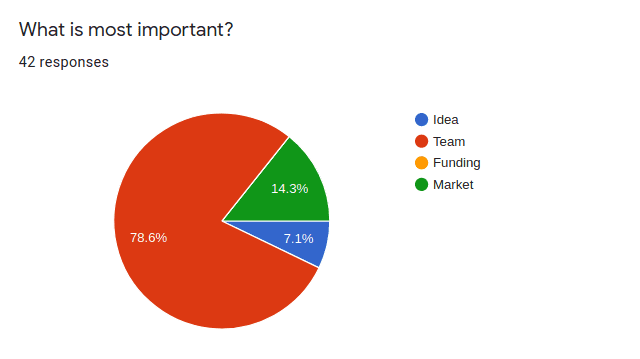

Idea

Successful companies and founders have a tendency to rewrite history to rationalize discovery and luck as forethought. However, even when companies pivot, they are likely constrained by their initial idea. My viewpoint is that the initial idea has as its chief purpose to be compelling enough to attract talent and funding. About two thirds of the respondents seem to agree.

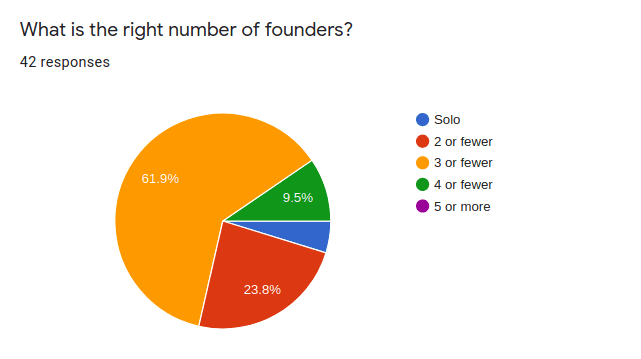

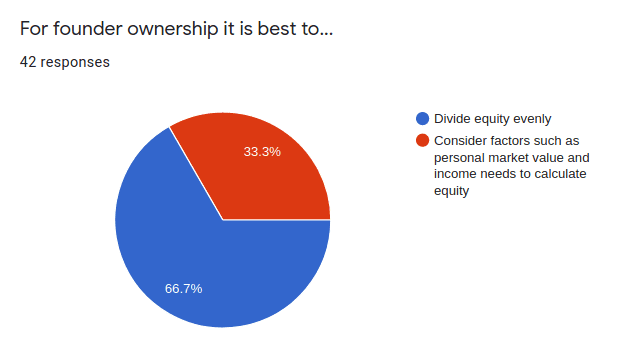

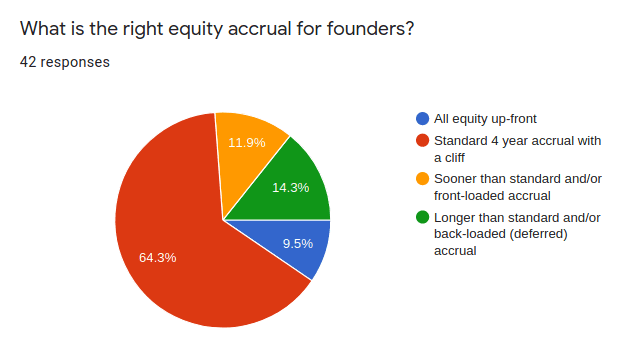

Founders

Results show tension between the number of founders and equity split. As the number of founders increases, it becomes more difficult to argue that everyone brings equal contribution. There might also be differences in risk tolerance in terms of income vs. equity ownership. I believe it would be healthy for founders to go through the exercise of defining a parameterized model for equity ownership, even if they later decide to disregard it. In terms of accrual, the respondents have similar expectations to employees, which I found surprising (I expected a more onerous accrual scheme). In practice, the initial arrangement evolves over time as departures and additional grants come into play.

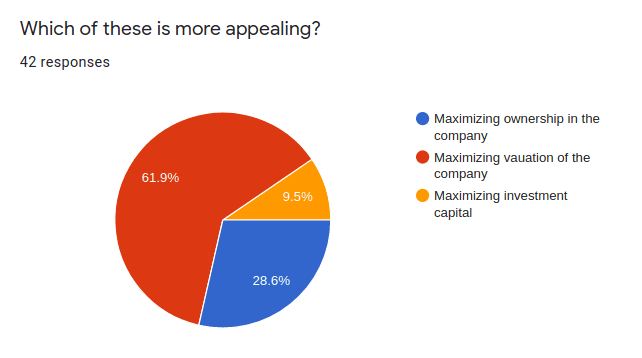

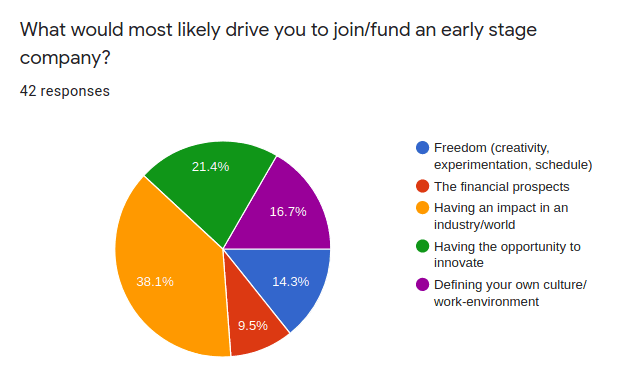

Motivation

When it comes to measures, the predominant optimization was towards valuation. This is a tough question because it’s so dependent on the stage and purpose of the company. On one hand, if we believe that valuations are representative of “value”, then it’s a good indicator. However, in early stages this is more like a vanity metric which can have negative consequences down the line (e.g. downrounds). Intrinsic motivation seems to be well distributed among the given choices, with “impact” coming a bit ahead of the rest.

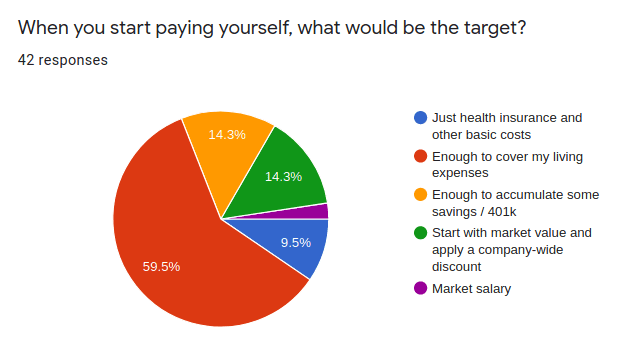

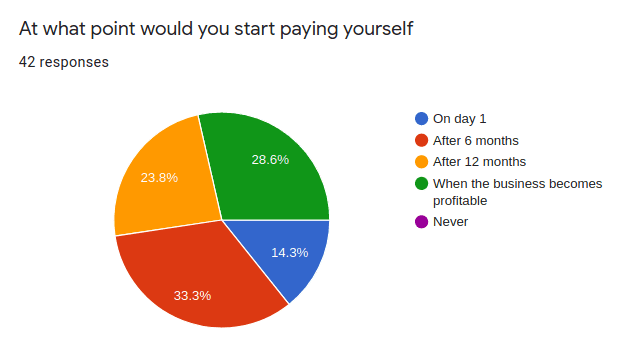

Income

A solid majority are comfortable paying themselves enough to cover basic costs of living. To the degree that founders and their families can support this arrangement, I strongly agree with not burning early capital in salaries. It’s worth considering the opportunity cost that varies from person to person based on market salaries, which is why I believe this supports a differentiated ownership model.

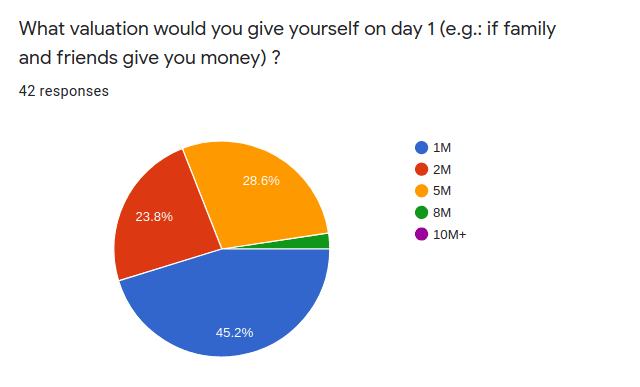

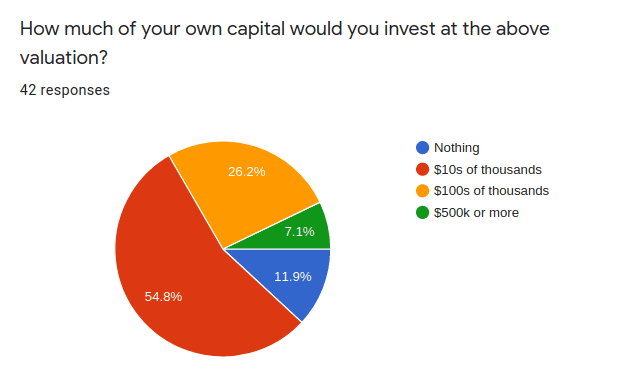

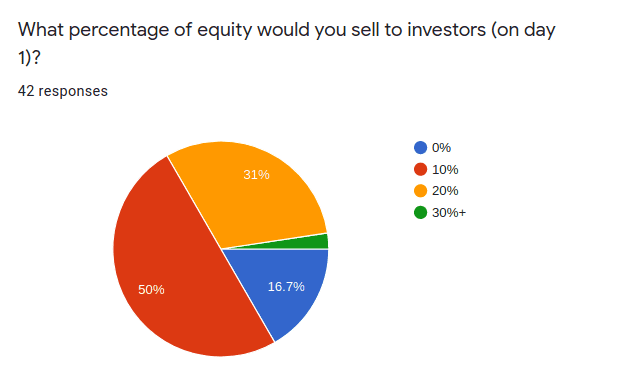

Valuation

I was surprised to see many responses in the sub $2M range. Going back to previous datapoints, if the company has 3 founders paying themselves a basic income for the first two years, the income deficit alone is in the $1-2M range. I expected the numbers to be closer to $5M, so this was sobering. Dilution expectations of 10-20% per round seem to be aligned with data I’ve seen elsewhere.